In Kuala Lumpur the chargeable rate for quit rent is about RM0035 per square foot per annum the rate may differ for different locations. The United States had such a system before the revolutionary war.

Assessment And Quit Rent Rylandcxt

We paste the old translation for you feel free to edit it.

. This payment has traditionally been charged to the Joint Management Body JMB of these buildings who pass on the costs through maintenance fees. Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. Quit rent better known as Cukai Tanah in Malay is a land tax collected by the state government through the land office.

This Act may be cited as the Quit Rents Act. In Budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices. If you own a 2500-square-foot terrace house you will have to pay RM8750 in quit rent every year.

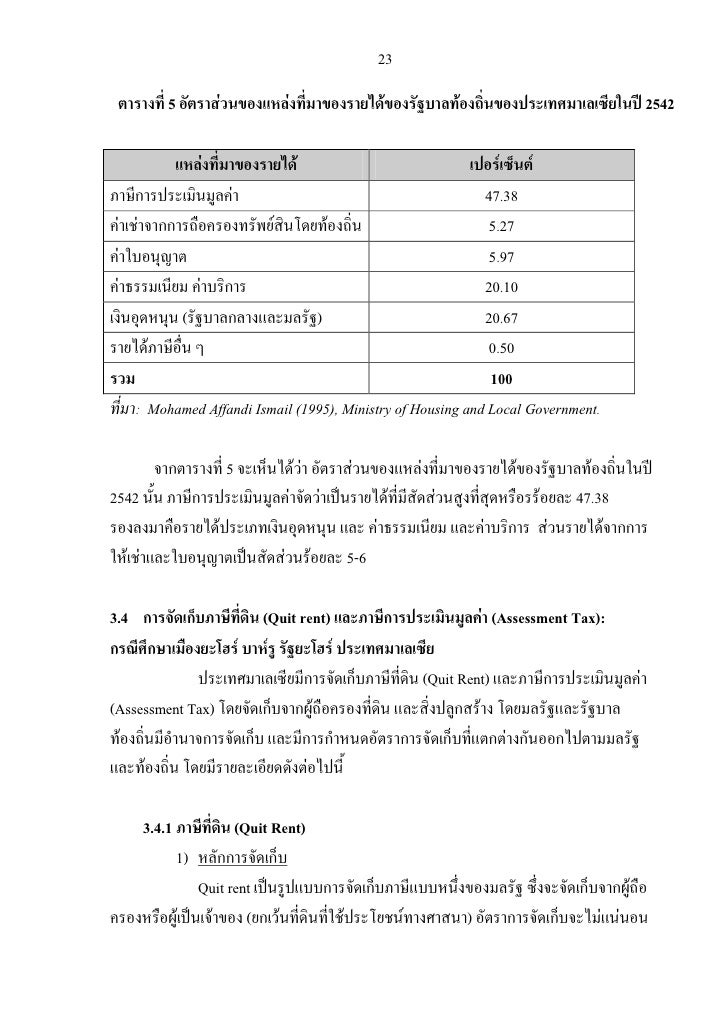

This is the highest income contributor to the Kuala Lumpur City Council DBKL. Act THE QUIT RENTS ACT EIIth April 18961 12 of 1985 Sch. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services.

In this Act the term quit rents means a quit rent of Definitionof five-sixths of a cent for each acre and for each fraction of quit rents. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Quit rent is paid to the state government via the respective Land Offices.

Quit rent quit rent malaysia quit rent and assessment what is quit rent land tax parcel rent. For instance the rates will be much higher if your house is located right smack in the middle of KL city compared to living in the quaint town in the east coast of. This imposed a ceiling on how much could be demanded in payment of a quit rent.

Redditus Quieti freed the tenant of a holding from the obligation to perform such other services as were obligatory under. In 1760 the colonial government passed a 10 year quit rent exemption on properties in the Lake Champlain area to encourage settlements in upstate New York and Vermont. QUIT RENTS 3 Cap.

Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. This system only persists in Malaysia in the 21st Century. The rates differ in each state depending on the property type and its location.

A local property tax which applies to all properties and is calculated on an annual rate of one to two sen per square foot. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967. In England quit rents were rents reserved to the king or a proprietor on an absolute grant of waste land for which a price in gross was at first paid and a mere nominal rent reserved as a feudal.

Quit rent or cukai tanah is a form of land tax collected by your state government for property in Malaysia. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Quit rent or cukai tanah is a form of land tax collected by your state government for property in Malaysia.

Quit rent Property size x State rate. As of 2018 Malaysia individual income tax rates are progressive up to 28. Quit rent is different from the assessment rates that is payable to the local city council.

Parcel rent is the rent or tax for a strata title parcel or temporary block calculated based on the square meter of each parcel together with its accessory parcel if any. Does Malaysia have property tax. You can calculate your quit rent with the following formula.

It will replace quit rent cukai tanah and unit owners. It is the replacement of a quit rent to property parcel owners with strata title. Regardless of whether they own a freehold or leasehold property and a landed or a stratified high-rise property they are obligated to pay quit rent.

Assessment tax is unique to Malaysia. Quit rent quit-rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns. Under feudal law the payment of quit rent Latin Quietus Redditus pl.

Add alternative translation for Quit-rent. Parcel rent is not a new tax. Quit rent quit-rent or quitrent is a tax or land tax imposed on occupants of freehold or leased land in lieu of services to a higher landowning authority usually a government or its assigns.

If you fail to pay a penalty charge on arrears is likely to be imposed by. The amount varies by state district and whether the land is located in urban or rural areas. For insights on what this expense is all about take a look at this article.

That is discharged from any other rent. Recent changes indicate a shift towards including this land tax as part of a separate charge billed. A rent paid by the tenant of the freehold by which he goes quit and free.

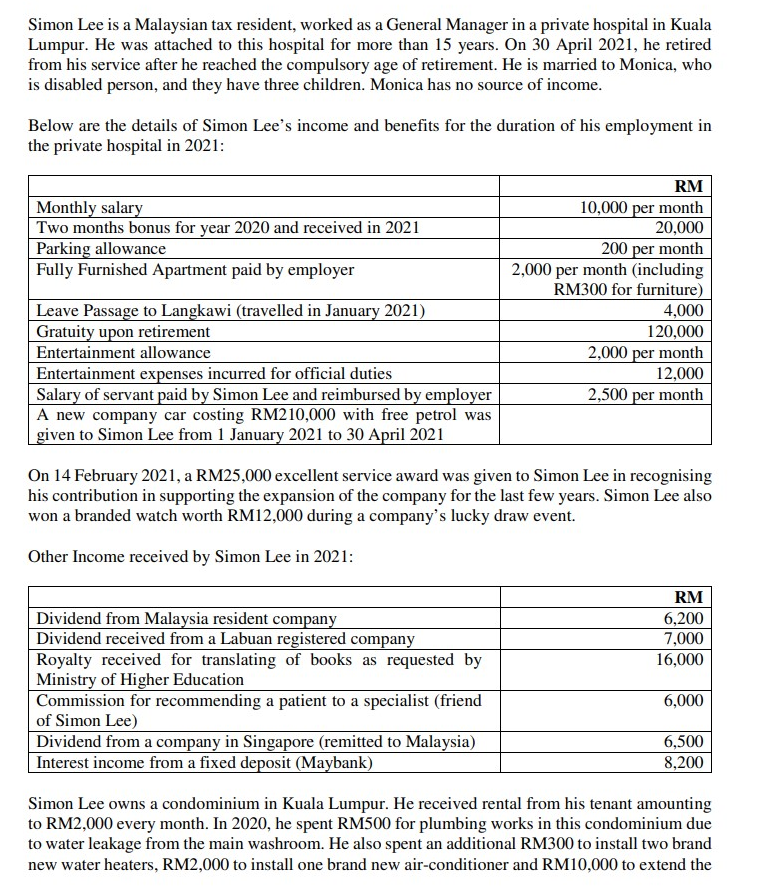

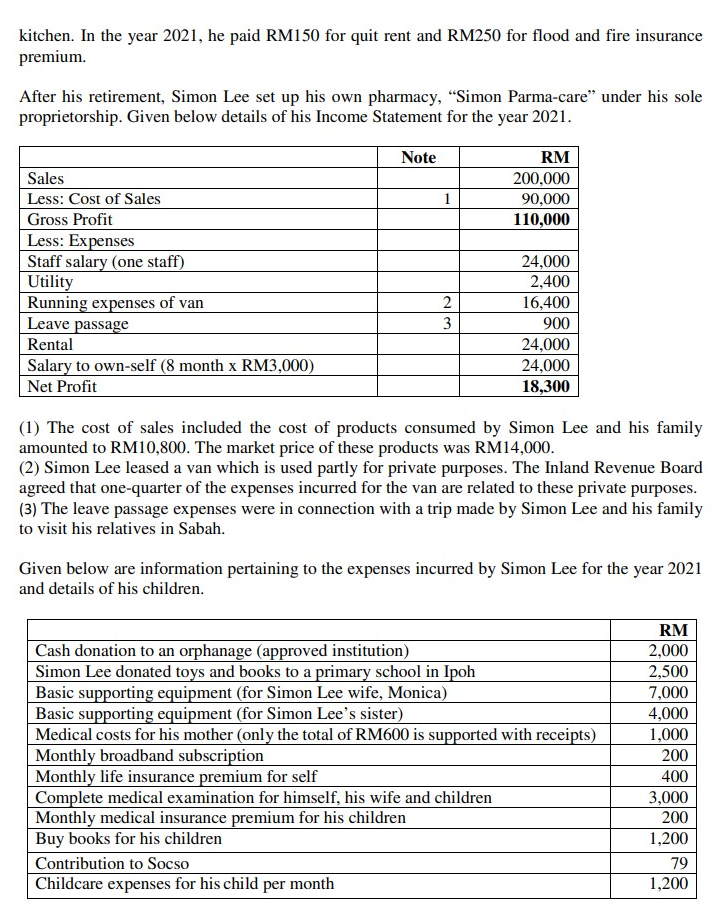

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

Simon Lee Is A Malaysian Tax Resident Worked As A Chegg Com

Renting In Malaysia Here Are 5 Common Legal Problems Asklegal My

Script For Case Management Google Docs Pdf Flow Tarikh P Writ Of Summon Soc 27th October 2020 P Affidavit Of Service 29th October 2020 D Course Hero

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

Common Test Tax667 Oct2019 Pdf Confidential 1 Ac Oct 2019 Tax667 Universiti Teknologi Mara Common Test 1 Course Advanced Taxation Course Course Hero

Sample Letter Pls Bantah Dbkl Assessment Increase Facebook

1 Q Tax667 Dec 2019 Pdf Confidential 1 Ac Dec 2019 Tax667 Universiti Teknologi Mara Final Examination Course Advanced Taxation Course Course Hero

Simon Lee Is A Malaysian Tax Resident Worked As A Chegg Com

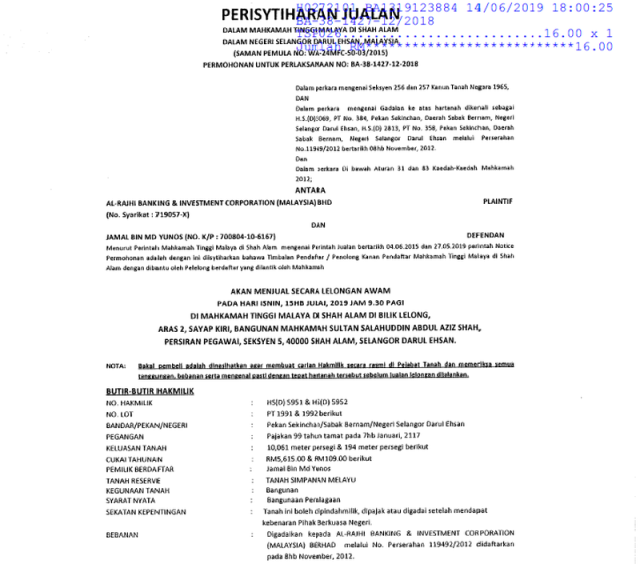

Fancy Acquiring A Resort Jamal Yunos Sekinchan Holiday Retreat Is Up For Grabs

Pin On Seri Pajam Home Instagram Post

Investing Investment Property Goods And Service Tax

Tax Ii Tutorial 4 Final Docx Ukat3033 Taxation Ii Tutorial 4 Question 1 Sedap Biskut M Sdn Bhd Tax Computation For Year Of Assessment Course Hero

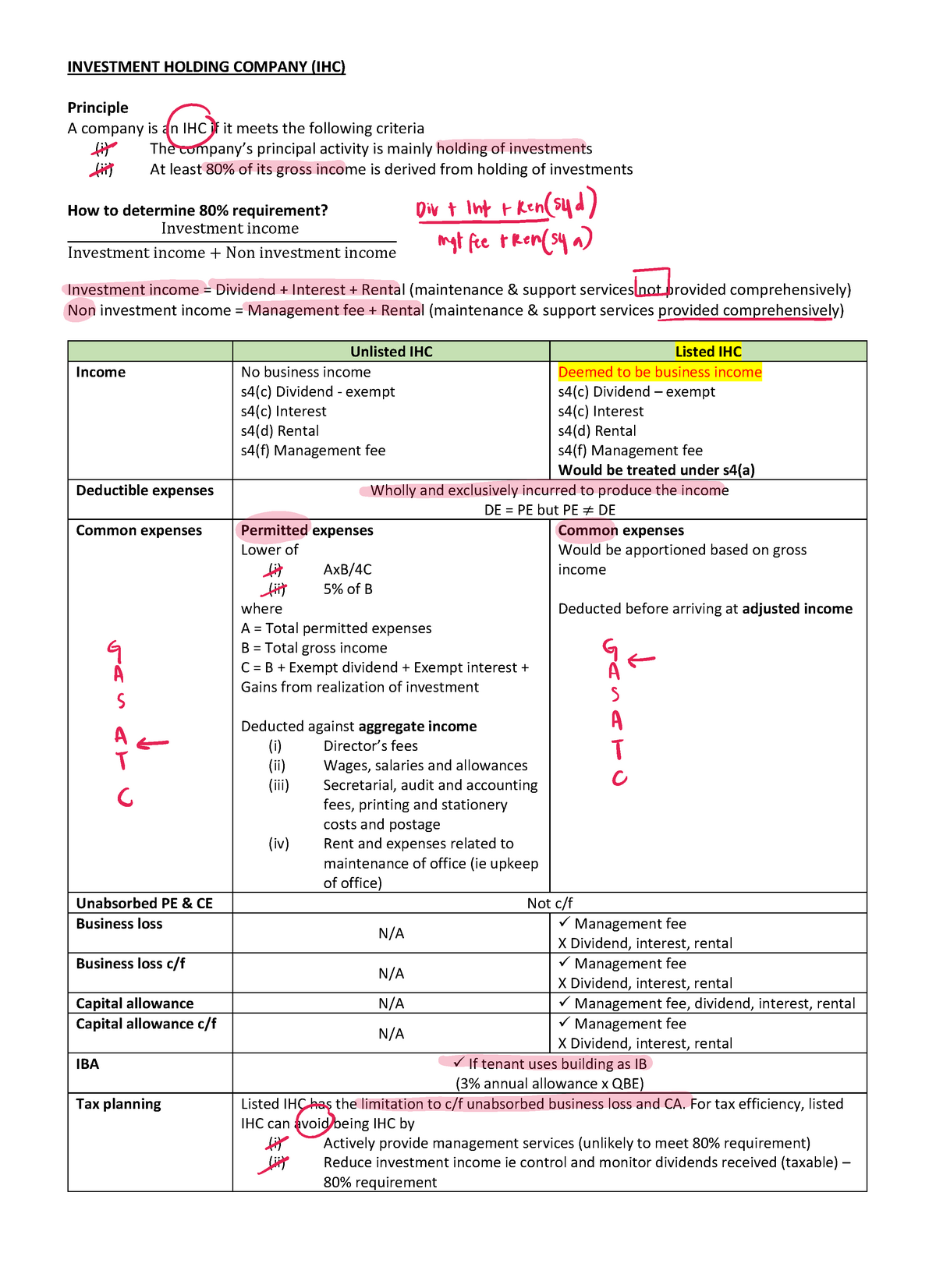

Ihc Advance Tax Malaysia Variant Warning Tt Undefined Function 32 Warning Tt Undefined Studocu